Heads up: Our content is reader-supported. This page includes affiliate links. If you click and purchase, I may receive a small commission at no extra cost to you.

According to the recent laws, all must link their PAN card with the Aadhaar number. Further, every person needs to quote their Aadhaar number while filing the income tax number or applying for a new PAN card. The recent changes in the laws are meant to offer benefits like pension, scholarship, subsidy on LPG, and much more.

Earlier, the deadline to link Aadhaar with a PAN card was till March 31, 2021, but there’s been an extension of the deadline. The last date to do so is by June 30 and there is no confirmation that whether the deadline will be further extended or not. If you fail to link Aadhaar with a PAN card then you may not be able to use your PAN card for financial transactions, the opening of a bank account, and much more.

Linking your Aadhaar with a PAN card can be done online and using SMS. Both these methods are simple to follow and are mentioned below for your convenience:

Link Aadhaar with PAN card via Income Tax portal (online)

For registered users – if you are aware of filing the tax returns, then you might have your Aadhaar linked with the PAN card already while filing previous ITR’s. Otherwise, you can check it by visiting the official website of tax e-filing which is www.incometaxindiaefiling.gov.in.

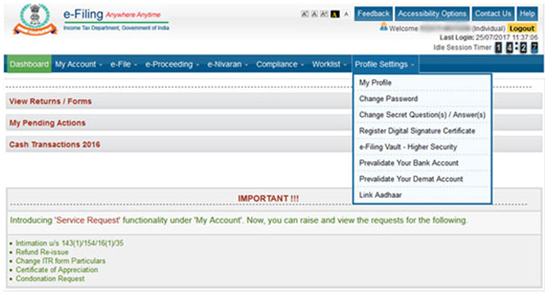

Login to this link by filling in your details like user ID, password, DOB, etc. After logging in tap on the ‘Profile settings’ option and click on the ‘link Aadhaar’ option.

Further, you will see the message, ‘Your PAN is linked to the Aadhaar number’.

But if it is not linked then you need to fill the appeared form with requested details like name, DOB, PAN records, Aadhaar number, etc. Later click on submit option after filling in the captcha code.

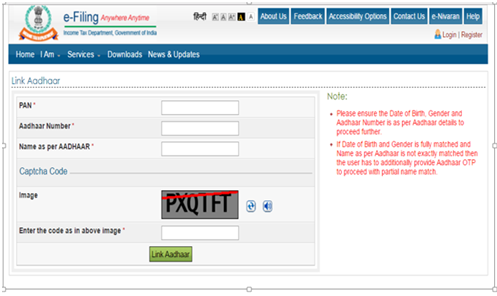

- For unregistered users – You can even link Aadhaar with a PAN card by clicking on the hyperlink shown on the homepage of the e-filing website without registering yourself.

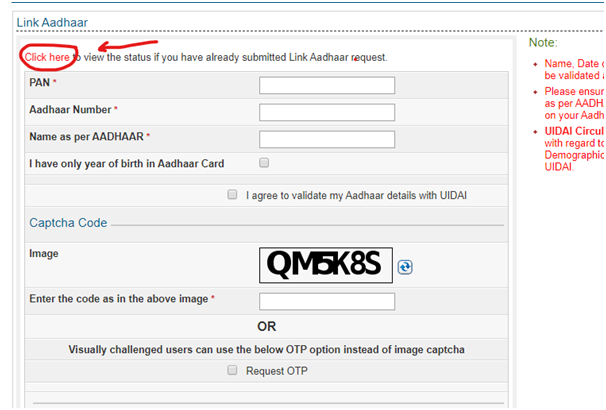

- Simply tap on the ‘Link Aadhaar’ option and a form will appear for you to enter the mandatory details, including Aadhar card, PAN card, and your name.

- In case, the Aadhaar card has only a year of birth then click on the option ‘I have the only year of birth on the Aadhaar card’.

Later click on the submit button.

So in a simple way:

- You have to visit the income tax portal

- Furnish your details, including Aadhar number, PAN number, and your name mentioned in both the documents.

- Mark the option if the birth year is given in your Aadhar card.

- Once you have filled in the details, enter the Captcha code correctly into the box.

- Finally, click on the ‘Link Aadhaar’ option.

Link Aadhaar with PAN Card via SMS service

- The initial step is to open messaging platform and send an SMS to the income tax department requesting them to link your PAN card with Aadhaar.

- Type this in your SMS: UIDPAN <12-digit- Aadhaar number><10-digit PAN number>

- This method should be followed religiously to link your Aadhaar with a PAN card. Also, included the provided spaces.

- Send the message on number 567678 or 56161.

- Later, the income tax details will go through your details and will link your Aadhaar with your PAN card.

How to check the status?

To check the status of your PAN and Aadhaar card linkage you have to :

- Visit the official portal of the Income Tax department.

- Click on the option, ‘Aadhar status’.

- Now enter your PAN and Aadhaar card numbers.

- Once you have successfully entered the details, click on ‘View Link Aadhaar Status’.

Importance of linking PAN with Aadhaar Card

- Will help the Income Tax department to detect all types of tax evasion.

- Restricts a person to own more than one PAN card.

- Will simplify the process of filing income tax returns.

- Vanishes the chances of getting PAN cancelled.

- Will help you to get access to the detailed income tax report attached to the Aadhaar Card.

FAQs

- What if the details on the PAN card are different from the ones furnished on Aadhaar card?

If the details are mismatched then you will have to correct them by filling up a form of correction along with a valid ID proof. Then only you can go ahead with the process of linking the Aadhaar card and PAN card.

- Does any documentary proof required while linking PAN and Aadhaar card?

No, there is no such documentary proof required unless the details are mismatched.

- What important details do I need to check while linking Aadhaar and PAN card?

Make sure to cross-check your name, date of birth, and gender. Make sure that the details should be the same on both.

Conclusion

While completing the entire process, ensure that you fill in the necessary details same as in your Aadhaar card. Plus, fill in the Aadhaar number and your name carefully. Both the methods are simple to follow and hardly takes a few minutes to complete.

To Know more about: How to e-file ITR? Complete guide to file your Income Tax Return online.