Heads up: Our content is reader-supported. This page includes affiliate links. If you click and purchase, I may receive a small commission at no extra cost to you.

Square is a financial technology company that offers payment processing and point-of-sale (POS) solutions for individuals and businesses. The company was founded in 2009 and has since become a popular payment processing solution for small businesses. Square provides a range of hardware and software products including card readers, mobile point-of-sale systems, invoicing, and more. Square’s services are accessible via the squareup.com website, where users can sign up for an account, manage payments, track sales, and access other features. Square’s mission is to make commerce easy for everyone, and its products are designed to provide a simple, user-friendly experience for businesses and individuals accepting payments.

Power your business with Square

Highlights

Here are some of the key highlights of Square:

- Easy to use: Square’s products are designed to be user-friendly, making it easy for individuals and businesses to accept payments and manage their finances.

- Range of products: Square offers a range of hardware and software products, including card readers, mobile point-of-sale systems, invoicing, and more.

- Financial management: Square provides a dashboard for users to manage payments, track sales, and access other financial management tools.

- Affordable: Square’s payment processing fees are competitive, making it a cost-effective solution for small businesses.

- Global availability: Square’s services are available globally, making it accessible to businesses and individuals around the world.

- Secure: Square uses secure payment processing technology to ensure the safety of users’ financial information.

Integration: Square integrates with various third-party tools, such as accounting software, to provide a comprehensive solution for businesses.

SquareUp Products

Square offers a range of hardware and software products to help businesses and individuals accept payments and manage their finances:

- Card Readers: Square offers a variety of card readers, including a mobile reader for iOS and Android devices, a chip card reader for in-person payments, and an contactless and chip reader for tap-and-go payments.

- Point-of-Sale Systems: Square’s POS system is a software solution that allows businesses to manage their sales, inventory, and customer data. It includes features such as reporting, employee management, and integrations with third-party tools.

- Invoicing: Square’s invoicing software allows businesses to send professional invoices to their customers, track payments, and view invoicing history.

- Online Storefront: Square provides a platform for businesses to create and manage an online store, including tools for customizing product pages, processing payments, and shipping orders.

- Square Capital: Square Capital provides business financing to eligible Square merchants, offering loans and advances based on their sales data.

- Square Payroll: Square Payroll is a payroll management solution for businesses, allowing them to easily pay employees and track taxes.

- Square Gift Cards: Square offers a solution for businesses to sell and manage gift cards, providing customers with a convenient way to purchase and redeem them.

Power your business with Square

SquareUp Business Types

Square is a payment processing company that offers services for various types of businesses. The types of businesses that can use Square’s services include:

- Retail businesses: Square provides point-of-sale (POS) systems for in-person transactions, as well as online and mobile sales.

- Service-based businesses: Square can be used by businesses that offer services such as hair salons, spas, and repair shops.

- Food and beverage businesses: Square provides solutions for restaurants, cafes, food trucks, and other food-related businesses.

- Healthcare businesses: Square’s payment processing services can be used by healthcare providers, such as dentists, chiropractors, and physical therapists.

- Non-profits: Square offers services for non-profit organizations to process donations and payments.

- Professional services: Square can be used by businesses such as law firms, accounting practices, and consulting firms.

- Online businesses: Square provides payment processing solutions for online and e-commerce businesses, including the ability to process payments through a website or mobile app.

These are some of the business types that can use Square’s services. The specific features and services offered may vary depending on the specific needs of each business.

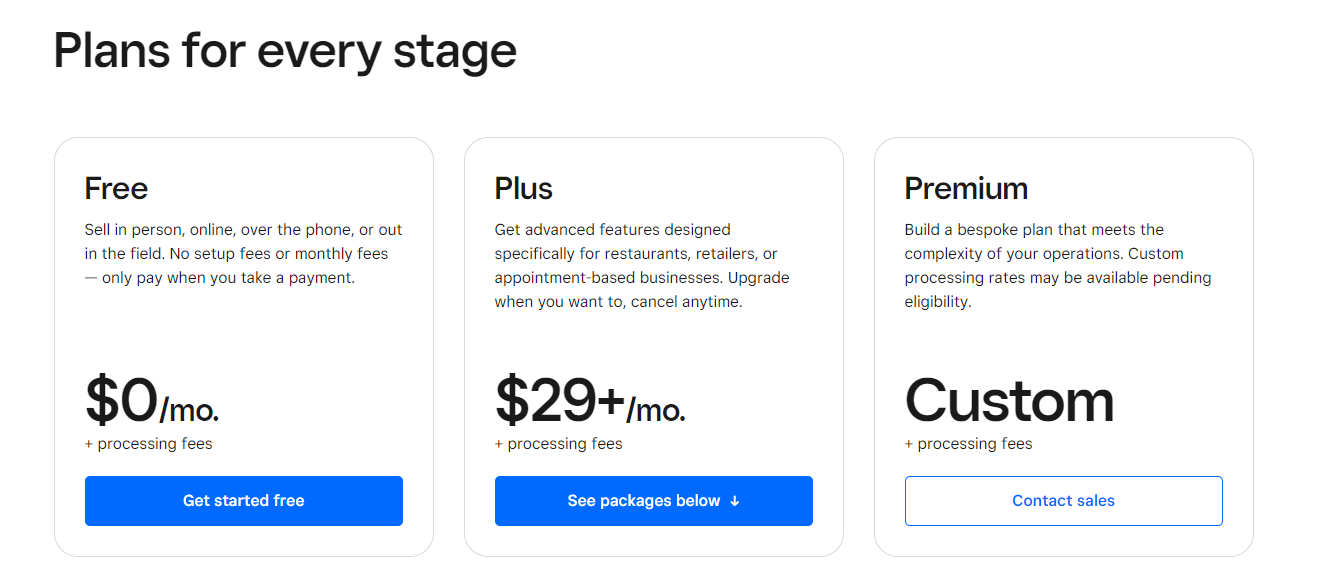

SquareUp Pricing

Power your business with Square

Square offers a range of pricing options for its payment processing services. Here is a general overview of Square’s pricing:

- Transaction fee: Square charges a flat fee of 2.6% + 10 cents per transaction for swiped, dipped, or tapped card transactions. For online transactions, the fee is 3.5% + 15 cents per transaction.

- Monthly fee: There is no monthly fee for using Square’s payment processing services.

- Card reader: Square provides a free card reader for its users, which can be used for in-person transactions.

- Additional hardware: Square offers a variety of additional hardware options, such as receipt printers, cash drawers, and barcode scanners, which can be purchased for an additional cost.

- Advanced features: Square offers advanced features, such as inventory management and appointment scheduling, for an additional monthly fee.

These are the basic pricing options for Square’s payment processing services. The exact pricing and features may vary depending on the specific needs of each business. It is recommended to check Square’s website for the most up-to-date information and to get an accurate estimate of the costs involved.

Why SquareUp to your business

Square is a popular payment processing company that offers a range of benefits to businesses. Here are some reasons why businesses choose Square:

- Easy to use: Square provides a user-friendly platform that is easy to set up and use, making it a great option for small businesses and startups.

- Affordable: Square’s pricing is competitive and transparent, with no hidden fees or long-term contracts.

- Versatile: Square offers a range of payment processing options, including in-person, online, and mobile payments, making it a good choice for businesses of all types and sizes.

- Customizable: Square offers various features and tools that can be customized to meet the specific needs of each business, such as inventory management, appointment scheduling, and employee management.

- Secure: Square follows industry-standard security protocols to protect sensitive information and ensure that transactions are secure.

- Widely accepted: Square is widely accepted by customers and is compatible with most major credit and debit cards.

These are some of the reasons why businesses choose Square as their payment processing solution. Whether a business is just starting out or looking to upgrade its existing system, Square can provide a cost-effective and flexible solution.

Is SquareUp Legit?

Power your business with Square

Yes, Square is a legitimate payment processing company. Square is a publicly traded company that has been in business since 2009 and has processed billions of dollars in transactions. The company is registered with the major credit card companies and follows industry-standard security protocols to protect sensitive information.

Square is also a member of the Better Business Bureau (BBB) and has received a rating of A+. Additionally, Square has received positive reviews from customers and is widely used by small businesses, freelancers, and large corporations.

In conclusion, Square is a legitimate and trustworthy payment processing company that is widely used and well-regarded in the industry. However, as with any financial service, it is important to carefully review the terms and conditions and to research the company before making a decision to use its services.

SquareUp Pros & Cons

Square is a popular payment processing company that offers a range of benefits and drawbacks for businesses. Here are some of the pros and cons of using Square:

Pros:

- Easy to use: Square’s platform is user-friendly and easy to set up, making it a good option for small businesses and startups.

- Affordable: Square’s pricing is competitive and transparent, with no hidden fees or long-term contracts.

- Versatile: Square offers a range of payment processing options, including in-person, online, and mobile payments, making it a good choice for businesses of all types and sizes.

- Customizable: Square offers various features and tools that can be customized to meet the specific needs of each business, such as inventory management, appointment scheduling, and employee management.

- Secure: Square follows industry-standard security protocols to protect sensitive information and ensure that transactions are secure.

- Widely accepted: Square is widely accepted by customers and is compatible with most major credit and debit cards.

Cons:

- Transaction fees: Square charges a flat fee of 2.6% + 10 cents per transaction for swiped, dipped, or tapped card transactions. For online transactions, the fee is 3.5% + 15 cents per transaction, which may be higher than some other payment processing companies.

- Limited support: Square’s support options may be limited, with some users reporting long wait times for phone support or difficulties getting their issues resolved.

- Limited customization: Square’s platform may not have as much customization options as other payment processing companies, which can be a drawback for businesses with specific needs.

- Limited integrations: Square may not have as many integrations with other business tools and software as some other payment processing companies, which can limit its usefulness for businesses with complex needs.

These are some of the pros and cons of using Square as a payment processing solution. As with any financial service, it is important to carefully review the terms and conditions and to research the company before making a decision to use its services.

How to Contact SquareUp

There are several ways to contact Square for support or to get help with specific issues. Here are the most common ways to reach Square:

- Square’s website: Square’s website offers a range of resources, including FAQs, articles, and videos, to help users resolve common issues.

- Email: Square can be reached by email at support@squareup.com.

- Phone: Square’s customer support can be reached by phone at 1 (855) 700-6000.

- Twitter: Square can be reached on Twitter at @SquareSupport.

- Live Chat: Square offers a live chat option for support on its website.

- Square’s app: Square’s app also offers a range of support options, including the ability to contact customer support directly through the app.

These are the most common ways to contact Square for support. It is recommended to check Square’s website for the most up-to-date information on how to reach the company for assistance.