Heads up: Our content is reader-supported. This page includes affiliate links. If you click and purchase, I may receive a small commission at no extra cost to you.

Summary

- Lululemon Athletica Inc. recently reported Q1 earnings and beat expectations, while raising guidance.

- In April, LULU held an investor day and boldly claimed they will double revenue within 5 years.

- LULU’s brand loyalty is impressive and the company has penetrated new markets, including subscription boxes, private gyms and more.

- Even sporting excellent growth, LULU’s valuation is stretched. I forecast a $370 price target with an 18-month view – equating to a “Buy”, but emphasizing caution due to an astronomical valuation vs. peers.

Purpose & Introduction

While Lululemon Athletica (NASDAQ:LULU) continues to grow at a strong pace and offers unique sales channels, the company’s multiples make it tough to support a large long-term position. However, buying in today at ~$300/share has value and I forecast a $370 price target over the next 18 months, based on a 2023 EV/EBITDA of 24 and a forward P/E of 39. I estimate 2022 EPS of $9.50 earnings per share after the guidance range jumped to $9.42-$9.57 from the previous $9.15-$9.35. LULU designs and sells athletic clothing for men and women. LULU focuses on apparel for healthy lifestyle and athletic activities, such as yoga, running, sports and more. They also provide footwear and other fitness-related accessories and sell products through a variety of areas, including company-operated stores; outlets/warehouse boutiques; interactive workout platforms; wholesale partners, including yoga studios, gyms, and health centers and license and supply arrangements. LULU also has an interactive app and sells product through their website. The company operates 574 stores under the lululemon brand in over 18 countries. LULU was founded in 1998 and remains headquartered in Vancouver, Canada.

While COVID suffocated retail apparel store traffic, LULU has continued to grow throughout the pandemic both in-person and digital sales. The company has continued to open stores globally, with a key focus on retail presence in China and South Korea. LULU opened 31 stores in China in 2021, the highest amount of any region. The company emphasizes large and clean store designs that act as brand incubators and smaller pop-up locations to test new markets, reach new guests, and grow overall brand awareness.

Q1 Earnings Review

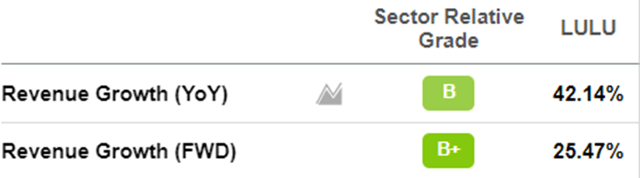

LULU reported strong first quarter earnings on June 2, 2022, that beat on both the top and bottom lines. LULU increased revenue 32% to $1.6B and increased revenue guidance toward $7.61B to $7.71B, up from a prior forecast of $7.49B to $7.62B. Comparable sales increased 29%, with a 24% increase in stores and a 33% increase in digital. Women’s sales grew 24% versus 2019 levels, while men’s grew 30%, fueling optimism in hitting their targets. The company was also able to mostly push inflationary costs into their prices, sporting a 54% margin (300 basis points worse than Q1 2021) and announcing a flat markdown rate. While inventory jumped 74%, LULU has continued to do a nice job of pulling forward inventory to meet demand and mentioned in the analyst call that they don’t anticipate a sizeable jump in their markdown rate.

LULU also noted that 15 of 71 stores in China were closed due to lockdowns, but stressed that their guidance baked in rolling shutdowns and that China is still a small portion of the overall sales mix. The company reaffirmed their “Power of 3” strategy both quantitatively and qualitatively. Along with beating analyst expectations, the company continued to move forward with their strategy by introducing new fabric innovation to support their new shoe line and a new Hiking line due to popular request from consumers. These developments are in line with their focus on athletics and could add meaningful revenue as the brand strengthens among men.

Strategy and Competitive Advantage

LULU has a multi-pronged strategy coined the “Power of 3” that has tangible goals that are serviced by a variety of avenues. This past investor day, LULU targeted three metrics for 2026 including doubling men’s revenue, doubling digital revenue and quadrupling international revenue. The company seems primed to at least come close to these goals after achieving their previous “Power of 3” targets.

LULU’s first target of exponentially increasing men’s revenue is based on their product innovation. LULU has focused on athletic and sports apparel and believes that the men’s segment and extending product categories are areas of opportunity. The company has an R&D lab called Whitespace, that uses sensory immersion to connect scientists across different industries, including neuroscience and biomechanics, to create the highest quality apparel. The company tested Canadian beach volleyball uniforms at a variety of different temperatures and weather simulations to best allow athletes to perform. This laser-focus on quality, along with service quality for their “quality promise” policy, gives them a strategic advantage and can allow them to penetrate the men’s athletic segment against competitors such as NIKE (NKE) and Under Armour (UAA).

LULU also believes that they can penetrate the footwear market with niche offerings by providing core accessories (i.e., trainer shoes) to their existing product lines (yoga/gym apparel). The management team continues to think outside the box, and has contributed to improving the brand value for years. Quality products that are backed with important and unique partnerships (i.e., Team Canada at the 2022 Olympics) help differentiate LULU against their peers.

The second strategic advantage for LULU is how they reach clients while being active. The company purchased Mirror back in 2020 to reach customers through at home workouts, but they have continued to imprint their brand during the customer activity cycle, with yoga rooms in some stores. Partnerships with gyms and yoga centers ensure that the brand is top of mind and monthly memberships allow inventory to flow through and connect customers to a like-minded community. These touchpoints with customers are unmatched within the industry and deliver a stronger connection with customers. These actions also allow digital revenue to continue to thrive and as they test the success of each touchpoint, international sales will follow suit as ideas and strategies are fleshed out. LULU’s deliberate use of the term “sweat” within their product lines is daring, but it presents an image of how they want to interact with customers and in an era of health-consciousness, it’s positive. Having a clear image of the brand significance and being present in different and unique avenues carries a noteworthy advantage over competitors.

Industry

LULU sells products that can be categorized within multiple segments in apparel, and have a notable focus in athleisure and sportswear. The company has key competitors that include Aritzia (OTCPK:ATZAF), adidas (OTCQX:ADDYY), Nike (NYSE:NKE) and Under Armour (NYSE:UAA). The global athleisure market is anticipated to expand at a CAGR of 7%, which would constitute $257B in sales by 2026. This segment continues to grow within apparel, and has tailwinds including the work from home movement for working out and health consciousness post-COVID. Meanwhile, the sportswear market is also expected to grow at a 7% clip into 2026 and post global sales of $267B. Both of these avenues are high growth areas and continue to be lifestyle changes rather than trends. With a focus on exponentially increasing men’s and international sales, I see LULU actively outperforming these anticipated growth rates and successfully penetrating into new markets.

When analyzing any apparel brand, there are key risks that are inherent to the business and cannot be fully mitigated. On a global level, there is risk associated with LULU’s inability to adapt to changing consumer preferences. There is also risk associated with pricing pressure given high inflation, notably if consumers don’t continue pay for premium apparel. Other key risks are their limited operating experience and limited brand recognition in new international markets. The company is focused on an Asian growth strategy, but it’s unknown whether they will penetrate Asia with the same success as in North America. Coupled with the zero COVID strategy of the Chinese government, there are serious international risks to hitting the third pillar of their strategy of quadrupling international growth. A final key risk concerns the Mirror acquisition and if the subsidiary will ever turn a profit – the company spent $500M on the at-home fitness provider and with recent weak results from Peloton (PTON), there is worry that this segment may lag long-term.

Model Shows Upside After Recent Dip

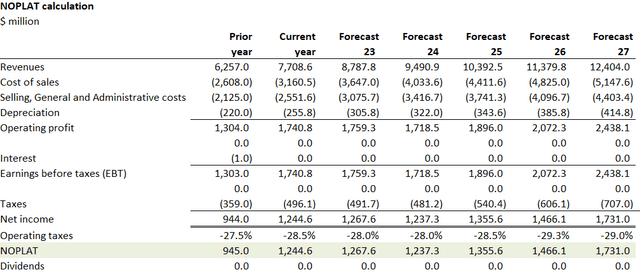

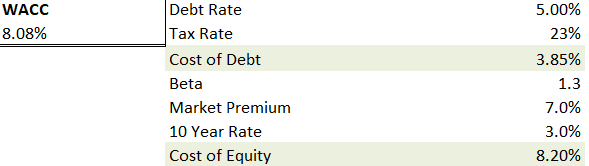

Should LULU deliver on their forecasted growth, its stock price is poised to jump from recent lows. LULU is primed to increase its free cash flow and get close to its goal of $12.5B in revenue within 5 years. The company has no debt and given their strong performance, I don’t anticipate their cost of debt (should they leverage) to rise above 5%. The weighted cost of capital is mostly based on the equity portion of the business, which leads to about

I forecast the continuing value of over $40B, given a 23% revenue increase this year, in the low range of their new forecast, before reducing four future years to a blended 11% growth due to brand concentration and headwinds on international growth efforts. I project a continuing growth rate of ~4% & WACC of ~8%, given their ability to adapt in ever-changing environments. The model projects revenue of $12.4B in 2026, just below the target of $12.5B. I see COGS jumping this year to 43% from 41.7% and remaining elevated vs. 2021 as air freight costs continue due to the ongoing global supply chain crunch. I see SG&A slowly creeping up by 1% before returning to 2021 figures in five years, as the company increases store counts and global advertising to achieve high growth. I hold all other key ratios mostly equal as a percentage of revenue from 2021 figures, as their old figures are distorted year-over-year with such exponential growth. As operating profit almost doubles in five years, a $374 share price can be supported with reasonable fundamentals. I assume the company completes its 2022 $1B share buyback plan to reduce the total amount of shares to ~131M outstanding.

LULU continues to be the growth story in large cap apparel globally. While the valuation remains stretched, the current opportunity to buy the dip has value. The company will need to hit on their Power of Three strategy to sustain a much higher multiple than their peers – though they have the foundation to achieve strong growth. LULU management has impressively penetrated multiple touchpoints to consumers without compromising their brand strength and loyalty. LULU is worth a Buy rating with a $370 target – though be cautious as the premium being paid is steep & the stock’s volatility is high.