Heads up: Our content is reader-supported. This page includes affiliate links. If you click and purchase, I may receive a small commission at no extra cost to you.

An income tax return is a mandatory form that needs to be filled to report the taxpayer’s yearly income to the Income Tax Department. It is an honest way to tell the government about your annual income in a specific financial year and all the taxes that you paid on the basis of your income. Now you can easily file your Income Tax Return online . Here is a complete guide how to e-file ITR(Income tax return) in few easy steps.

Who has to file an ITR?

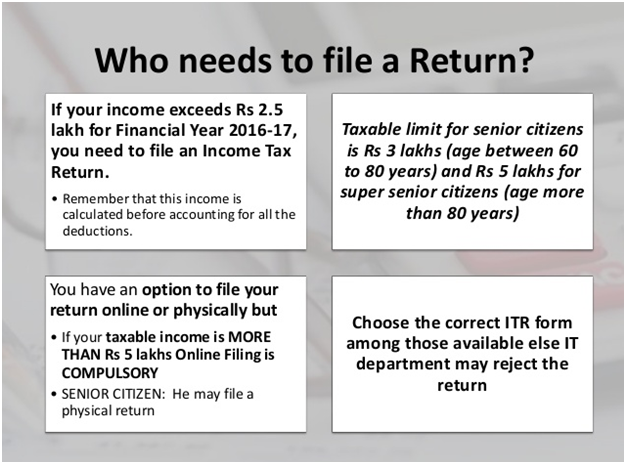

As per the latest guidelines of the Income Tax Department, every person whose total annual income during the financial year increases the laid exemption limit has to file an ITR return.

The exemption limit as per the age

The basic exemption limit for any person entirely depends upon her/his age. Currently, the exemption limits are:

2, 50,000 for below 60 years of age

3, 00,000 for those who fall between 60 and 80 years of age.

5, 00,000 for senior citizens, especially 80+.

If the gross total income surpassed the above-mentioned amount in each category then you have to file an income tax return.

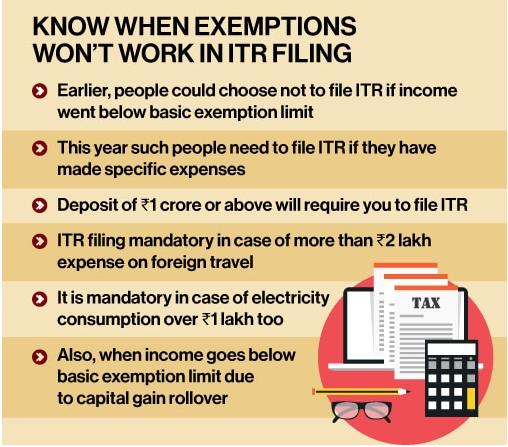

However, even if your gross total income doesn’t surpass the prescribed exemption limit mentioned above, you have to file an income tax return if:

- You have spent an amount of more than 2 lakh or on anyone else for a foreign tour.

- if you have a deposit of more than 1 crore in your current account with a bank.

- You have paid an electricity bill amounting to Rs 1 lakh during the financial year.

How to register yourself on the e-filling portal?

The method of electronically filing Income Tax Returns (ITR) via the internet is known as E-filing. To e-file, your ITR is simple and quick. All you need is a good internet connection and by sitting on your couch or office desk, you can complete this process.

Plus, E-filing ITR can be money-saving as there is no requirement of hiring an individual or agent to file ITR. To follow the process of E-filing your ITR, here is a step-by-step guide on login or register on the e-filing ITR portal:

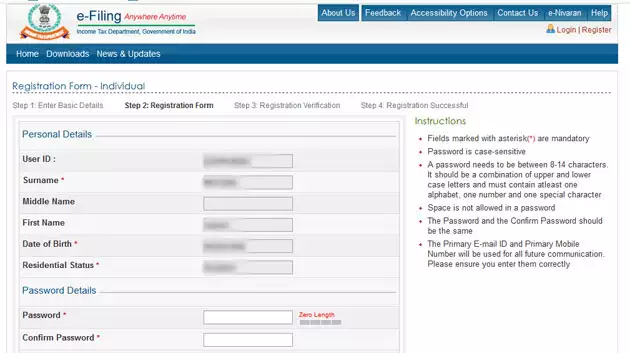

- Visit the website https://incometaxindiaefiling.gov.in

- Register or login yourself to e-file your ITR. If you have already registered yourself then click on the ‘login here’ button. Otherwise, click on the ‘register yourself’ button.

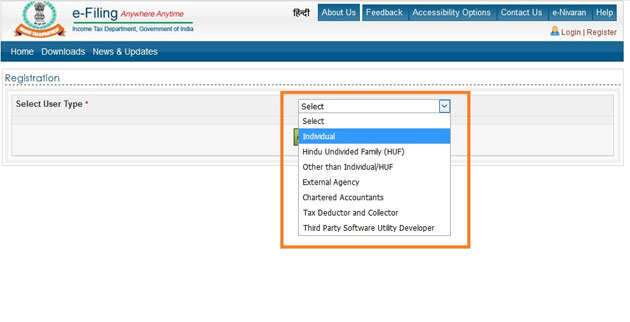

- Choose the user type. The available options are individual, Hindu undivided family, other individuals, external agency, tax deductor, etc. Also, you need to fill in your current address and permanent address before hitting submit button.

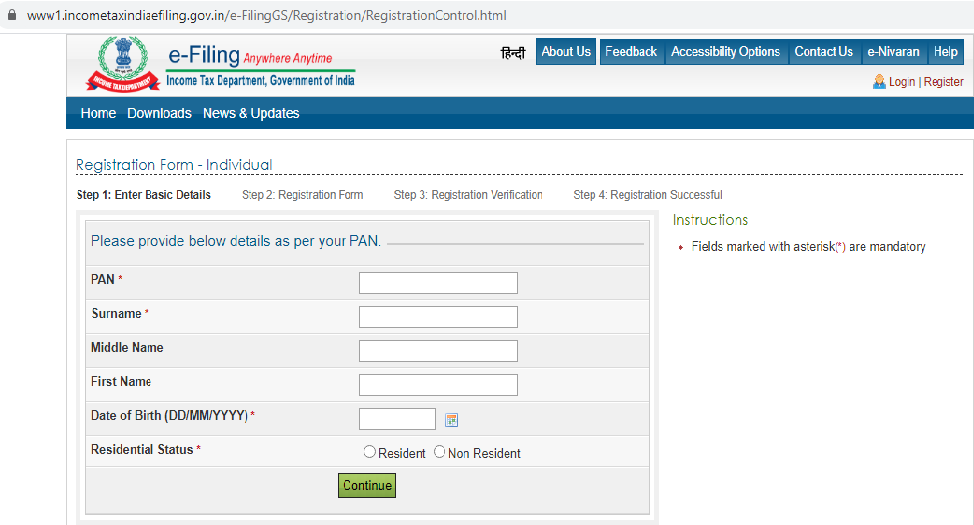

- Enter the basic details like name, PAN, date of birth, contact details like email ID or phone number.

- Verification of PAN

- Activation of account via a link sent at email ID

Complete guide to e-file your ITR on the portal

Below mentioned are the steps to e-file your ITR (income tax returns) via the income tax e-filing portal:

- Firstly, calculate your income tax liability according to the provisions of the income tax laws.

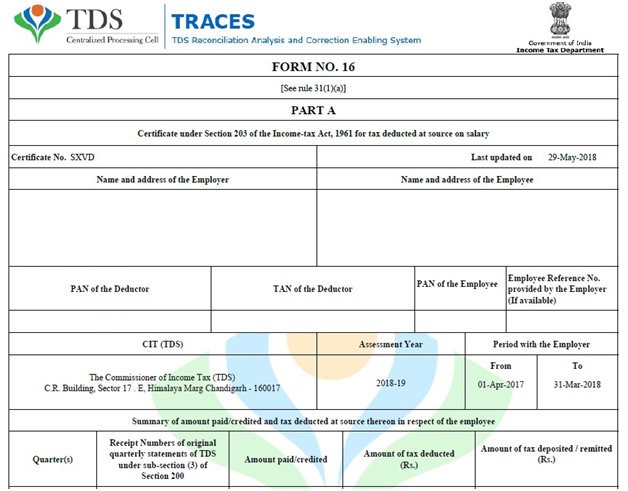

- Go for Form26AS to review the TDS payment for all 4quarters of the assessment year.

- Depending on the definition given by the ITD (income tax department) for every ITR form, decide under which category do you fall and later select the ITR form accordingly.

- Visit the official website of ITR e-filing which is https://incometaxindiaefiling.gov.in.

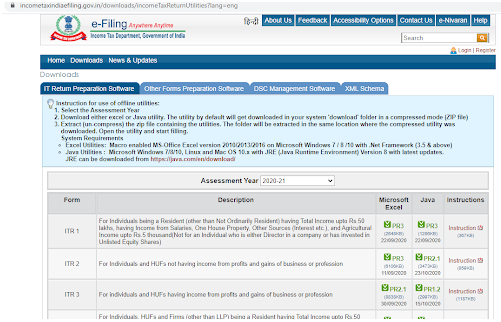

- Click on the option ‘IT Return Preparation Software’ which can be seen under the ‘Download’ section.

- Download the offline utility after selecting the assessment year. The person can download a Java utility file or MS Excel file.

- After downloading the offline utility file, complete the field that is relevant to your income, tax payable, or receivable refunds.

- Once you are done with filling up the form, tap on the ‘Validate’ button available on the form to ensure that all the important fields are filled up by you.

- The next step is to tap on the ‘Generate XML’ button. This way you can convert the file into an XML file.

- Log in on the income tax e-filing portal again by using your credentials.

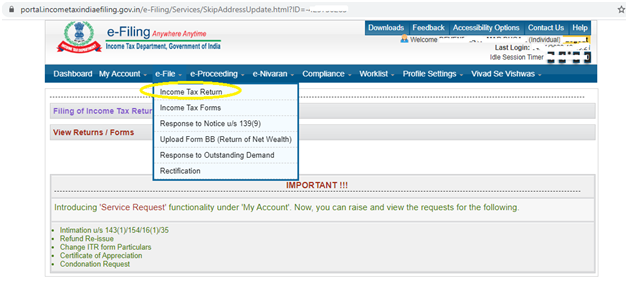

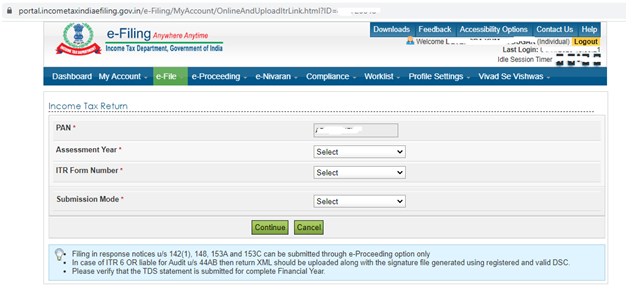

- Click on the ‘Income Tax Return’ option which can be seen under the ‘file option on the main menu.

- Fill the fields with all the necessary information like PAN, assessment year, submission mode, Income Tax Return form number. Go for the drop-down menu option to select the ‘Upload XML’ seen under the ‘Submission Mode’ field.

- Press the ‘Continue’ button and upload your XML file which is saved on your computer or laptop.

- Now press on the ‘Submit’ option and choose the mode of verification such as electronic verification code (EVC), Aadhaar OTP, and much more.

How to file an income tax return offline? Especially for senior citizens

Those who are above 80 years old can also file their ITR at the Income Tax Department for a particular financial year.

What’s the process?

First off, take Form 16.

Submit your ITR returns in a physical form at the Income Tax Department.

If the form is submitted successfully, the IT department will send you an acknowledgment slip.

What if you didn’t file an ITR?

If you forgot to file an ITR and willing to file it now then follow the steps given below:

If you forgot to file an ITR and willing to file it now then follow the steps given below:

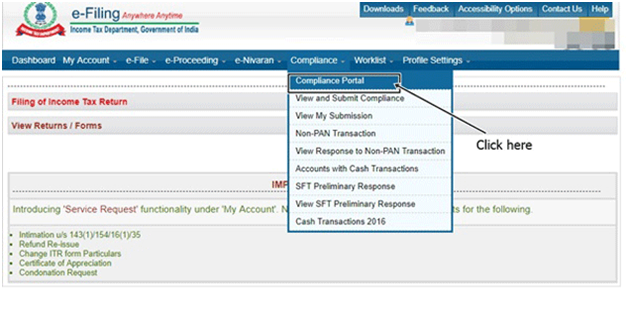

- First off, login to the official portal of the Income Tax Department

- Go to the ‘Compliance’ section where you will get two choices, View and submit my compliance, and ‘View my submission’.

- The first option is meant to showcase the information for the assessment year when you didn’t file the return as per the IT department. Then you will further get two more options, ‘the return has been filed’, and ‘the return has not been filed.

- If you will choose the former option then you will get to see 4 options, including ‘return under preparation’, ‘no taxable income’ ‘business has been closed, or others. You have to pick the right option as per your case and then hit on ‘Click’ button.

FAQs

- How many types of forms available online?

You can find out multiple forms on the official portal of IT department. Every form has its own purpose. Some of the popular forms that available at the portal are ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, ITR-V, and ITR-7.

- How e-filling is different from e-payment?

The process of e-filling means the submission of the returns at the official portal of the IT department. However, e-payment means that you are paying taxes online via State Bank of India’s credit/debit or net banking methods.

- What if I don’t file IT returns?

In case you will not file IT returns on time then you have to pay penalties, extra fees, or extra interest. You may also face legal action from the IT department.

Conclusion

The process to e-file your ITR is quite simple and requires few minutes of your day. Ensure that you follow the process above mentioned in the same way to avoid any issues.

To Read More About: How to back up your Android phone and keep all of your important information safe.