Heads up: Our content is reader-supported. This page includes affiliate links. If you click and purchase, I may receive a small commission at no extra cost to you.

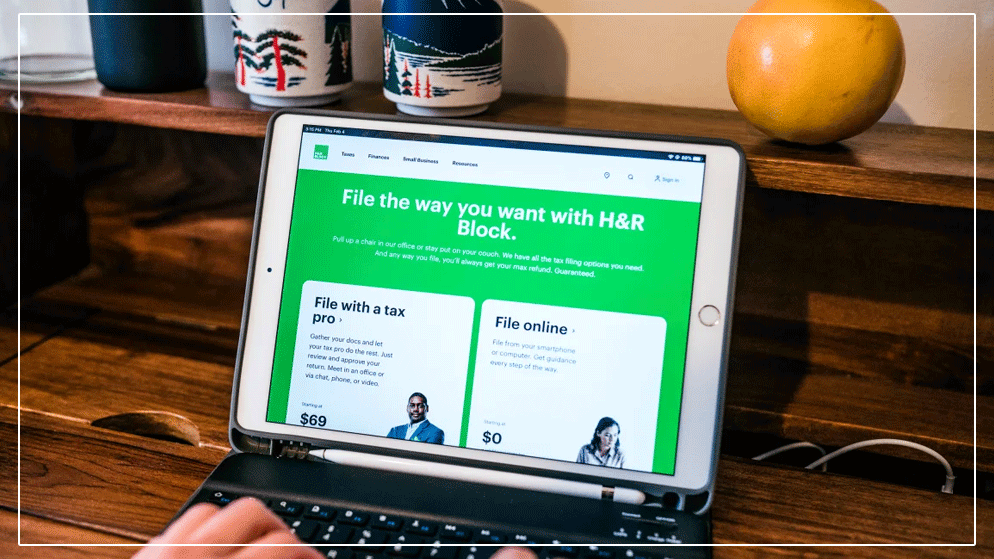

H&R Block is a tax preparation company founded in 1955 by brothers Henry and Richard Bloch. The company is headquartered in Kansas City, Missouri, and offers a range of tax preparation products and services for individuals and small businesses. H&R Block’s products include online tax preparation software, in-person tax preparation services, and specialized products for small business owners and investors.

The company is known for its extensive network of retail tax preparation offices, which can be found throughout the United States and in many other countries around the world. In addition to tax preparation services, H&R Block offers a variety of features and services such as tax calculator tools, tax tips and advice, tax identity protection, refund advances, and small business services.

H&R Block has helped millions of taxpayers prepare and file their tax returns over the years, and is recognized as one of the leading tax preparation companies in the United States.

Who should use H&R Block tax software?

H&R Block tax software is suitable for individuals, small business owners, and self-employed taxpayers who want to prepare and file their own taxes. The software is designed to be user-friendly and intuitive, even for individuals who may not have a lot of experience with tax preparation.

H&R Block tax software is particularly useful for people who have relatively simple tax situations, such as those who have a single job, no dependents, and no major investments or deductions. However, the software can also handle more complex tax situations, such as those involving rental properties, investment income, and self-employment income.

In addition, H&R Block tax software offers a range of features and tools that can help users maximize their tax savings and minimize their tax liability. These include step-by-step guidance, error checking, and the ability to import tax data from previous years or other sources.

What are H&R Block’s different products?

H&R Block offers several different tax products that are designed to meet the needs of different types of taxpayers. These products include:

- H&R Block Online: This is a web-based tax preparation software that is suitable for individuals and small business owners who want to prepare their taxes from the comfort of their own home. It offers step-by-step guidance and error checking, and can import data from previous years or other sources.

- H&R Block Tax Pro Go: This product is designed for taxpayers who want the convenience of having a professional tax preparer prepare their taxes for them. Users can upload their tax documents to a secure portal, and a tax professional will prepare their taxes remotely.

- H&R Block Tax Software: This is a desktop-based tax preparation software that can be installed on a computer. It offers all the features of H&R Block Online, but with the added convenience of being able to work offline.

- H&R Block Mobile App: This is a mobile app that can be downloaded to a smartphone or tablet. It offers many of the same features as H&R Block Online, but with the added convenience of being able to prepare taxes on the go.

- H&R Block Emerald Prepaid Mastercard: This is a prepaid debit card that can be used to receive tax refunds or make purchases. It offers features such as cash back rewards and online bill pay.

H&R Block products, compared

H&R Block offers several different tax products that vary in their features, pricing, and suitability for different types of taxpayers. Here’s a comparison of the key features of each product:

- H&R Block Online: This is a web-based tax preparation software that is suitable for individuals and small business owners who want to prepare their taxes online. It offers step-by-step guidance, error checking, and can import data from previous years or other sources. The pricing for H&R Block Online ranges from free to around $80, depending on the complexity of the tax return.

- H&R Block Tax Pro Go: This product is designed for taxpayers who want the convenience of having a professional tax preparer prepare their taxes for them. Users can upload their tax documents to a secure portal, and a tax professional will prepare their taxes remotely. The pricing for H&R Block Tax Pro Go ranges from around $69 to $229, depending on the complexity of the tax return.

- H&R Block Tax Software: This is a desktop-based tax preparation software that can be installed on a computer. It offers all the features of H&R Block Online, but with the added convenience of being able to work offline. The pricing for H&R Block Tax Software ranges from around $30 to $80, depending on the version and complexity of the tax return.

- H&R Block Mobile App: This is a mobile app that can be downloaded to a smartphone or tablet. It offers many of the same features as H&R Block Online, but with the added convenience of being able to prepare taxes on the go. The pricing for the mobile app is similar to the pricing for H&R Block Online, ranging from free to around $80.

- H&R Block Emerald Prepaid Mastercard: This is a prepaid debit card that can be used to receive tax refunds or make purchases. It offers features such as cash back rewards and online bill pay. There is no fee to activate the card, but users may be charged fees for certain transactions, such as ATM withdrawals.

Is H&R Block Online Assist worth the cost?

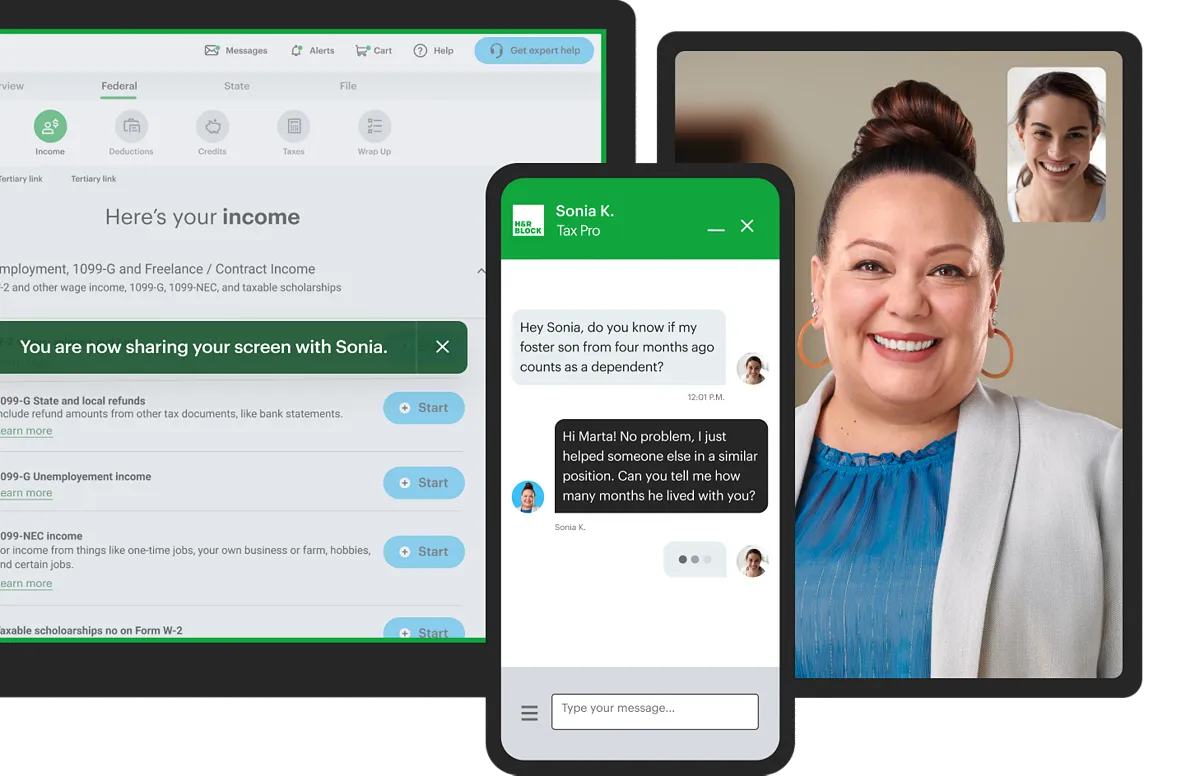

H&R Block Online Assist is a premium service offered by H&R Block that provides users with unlimited access to a tax expert who can provide personalized guidance and advice throughout the tax preparation process. The service can be added to any of H&R Block’s online tax products for an additional fee.

Whether or not H&R Block Online Assist is worth the cost depends on the individual taxpayer’s needs and preferences. Here are some factors to consider:

- Complexity of tax situation: If you have a relatively simple tax situation, such as a single job with no major investments or deductions, you may not need the assistance of a tax expert and may be able to complete your tax return on your own using H&R Block’s online tax software. On the other hand, if you have a more complex tax situation, such as self-employment income or rental property, you may benefit from the guidance of a tax expert.

- Comfort level with tax preparation: If you are comfortable preparing your own taxes and feel confident in your ability to do so accurately, you may not need the assistance of a tax expert. However, if you are unsure about certain aspects of tax preparation or want to ensure that you are maximizing your tax savings, the expertise of a tax expert may be helpful.

- Budget: H&R Block Online Assist is an additional expense on top of the cost of H&R Block’s online tax software. If you are on a tight budget and prefer to save money on tax preparation, you may not want to pay for the extra assistance.

Other Notable features H&R Block offers

In addition to its tax preparation software and services, H&R Block offers a range of other features that may be of interest to taxpayers. Here are some notable features:

- Tax calculator tools: H&R Block offers several free online tax calculator tools, including a tax refund estimator, a tax bracket calculator, and a self-employment tax calculator. These tools can help taxpayers estimate their tax liability and plan accordingly.

- Tax tips and advice: H&R Block offers a variety of tax tips and advice on its website, including articles on tax deductions and credits, tax reform changes, and tax planning strategies. There are also resources available for small business owners and self-employed taxpayers.

- Tax identity shield: H&R Block offers a Tax Identity Shield program that helps protect taxpayers from identity theft during tax season. The program includes monitoring of tax-related activity on credit reports, alerts for suspicious activity, and assistance with restoring identity if theft occurs.

- Refund advance: H&R Block offers a Refund Advance program that allows eligible taxpayers to get an advance on their tax refund, up to $3,500. The advance is offered as a loan, which is repaid from the taxpayer’s tax refund.

- Small business services: H&R Block offers a range of services for small business owners, including bookkeeping, payroll, and tax preparation. These services can help small business owners stay organized and compliant with tax regulations.

Summary

H&R Block is a tax preparation company that offers a range of products and services for taxpayers. Its products include online tax preparation software and in-person tax preparation services, as well as specialized products for small business owners and investors. One of H&R Block’s premium services, Online Assist, offers unlimited access to a tax expert for personalized guidance and advice throughout the tax preparation process. In addition to tax preparation services, H&R Block offers a variety of features such as tax calculator tools, tax tips and advice, tax identity protection, refund advances, and small business services.

![Hello Fresh Review: [Fresh Food & Meal Kit Delivery]](https://scoopbiz.com/wp-content/uploads/2023/04/Hello-Fresh-12.jpg)